페이스북,메신저 서비스에 송금 기능 도입 Facebook's Money Transfer Service Could Hurt Western Union, MoneyGram, PayPal, And Xoom

미국 은행 발행 비자나 마스터 직불카드 있어야

서비스 이용료는 무료

source http://www.newvision.co.ug/news/654725-facebook-to-launch-e-money-transfer-service.html

edited by kcontents

케이콘텐츠

세계 최대 소셜 미디어인 페이스북이 메신저 서비스에 페이스북 친구들끼리 돈을 부치고 받을 수 있는 송금 기능을 도입키로 했다.

이에 따라 중국 알리바바의 알리페이와 미국 페이팰의 벤모, 그리고 스퀘어 등이 이끌어 온 개인간 전자송금 서비스의 판도에 큰 변화가 예상된다.

페이스북 메신저 송금은 몇 달 후 미국부터 적용될 예정이며, 미국 은행이 발행한 비자나 마스터 직불카드가 있어야만 한다. 서비스 이용료는 무료다.

페이스북은 17일(현지시간) 보도자료를 통해 이런 내용을 발표했다. 페이스북 메신저의 송금 기능을 이용해 친구에게 돈을 부치려면 ▲ 친구와 메시지 대화를 시작한 후 ▲ '$' 아이콘을 두드린 후 원하는 송금 금액을 입력하고 ▲ 우측 상단에 있는 '송금' 버튼을 누른 후 본인 직불카드 번호를 입력하면 된다. 친구가 페이스북 메신저를 통해 부친 돈을 받으려면 ▲ 메시지 대화 창을 연 후 ▲ 메시지에 나온 '카드 추가' 버튼을 두드리고 본인 직불카드 번호를 입력하면 된다. 일단 직불카드 번호를 입력하면 그 후로는 다시 입력할 필요가 없다. 직불카드 번호를 입력한 후에는 비밀번호를 만들 수 있으며, 아이폰 등 iOS 기기에서는 지문 인식 방식의 터치 아이디로 보안을 강화할 수 있다. 계좌 이체는 즉각 이뤄지며, 다만 다른 이체 거래의 경우와 마찬가지로 이체가 이뤄진 돈이 인출 가능 상태가 되려면 은행에 따라 1∼3 거래일이 걸릴 수 있다. 이 결제 시스템은 안드로이드, iOS, 데스크톱에서 사용 가능하다. 페이스북은 이와 관련된 모든 시스템을 자체적으로 운영키로 했으며, 이에 따라고객의 직불카드 정보 등 정보는 페이스북 서버에 보관된다. 페이스북은 "이 결제 시스템은 페이스북 네트워크의 다른 부분과 분리되어 운영되며 추가로 감시와 통제를 받는다"며 "사기 방지 전문가들로 이뤄진 팀이 수상한 구매 활동을 모니터하도록 할 것"이라고 강조했다. 페이스북은 작년 6월 페이팰 사장이던 데이비드 마커스를 메시징 제품 담당 부사장으로 영입하는 등 이 분야 진출에 오래전부터 공을 들여 왔다. 메신저와 모바일 결제를 결합하려는 시도는 최근 전 세계적으로 주목을 받고 있다. 메신저의 경우 가입할 때 특정 모바일 단말기나 전화번호를 확인할 수 있는 경우가 많아 금융 거래의 필수 요건인 신원 확인에 유리하다는 점 때문이다. 페이스북이 다른 소셜 미디어들보다 실명 확인을 더욱 강조해 온 점과 게임 등으로 결제 분야에 대한 경험이 쌓여 있는 점도 모바일 송금 분야 진출에 유리하게 작용할 것으로 보인다. 페이스북은 자사 플랫폼에서 동작하는 온라인 게임들의 아이템 거래 등으로 작년에 10억 달러에 가까운 결제를 대행한 바 있다. 연합뉴스 |

Facebook's Money Transfer Service Could Hurt Western Union, MoneyGram, PayPal, And Xoom

Summary

- Facebook officially confirms it is activating the money transfer feature in Messenger.

- The money transfer service will start in the U.S. but I believe that it will gradually expand to others countries.

- The money transfer feature might also be implemented in WhatsApp.

My call for Facebook (NASDAQ:FB) to activate the hidden money transfer option in Messenger just got realized yesterday. Facebook made it clear that the peer-to-peer money transfer feature will roll out this year for the PC, Android, and desktop version of Facebook Messenger. This super convenient money transfer method coupled with the 500 million user base of Messenger could hurt Western Union (NYSE:WU), Xoom (NASDAQ:XOOM), and MoneyGram (NASDAQ:MGI).

The peer-to-peer method of sending money inside Facebook Messenger is much more convenient than what Western Union and MoneyGram offers right now. People will only have to launch the Messenger app from their phones or tablets, send a message to a friend, click the $ icon, input the amount of the money to send, and then add a Visa (NYSE:V) or Mastercard debit card to complete the procedure of sending the money.

(click to enlarge)

Source: Facebook

Since Facebook is now only allowing debit cards to be used, the peer-to-peer money transfer feature is still a free service. A free way to send money among 500 million users will obviously affect Western Union, Xoom, MoneyGram, and other traditional/digital money remittance firms.

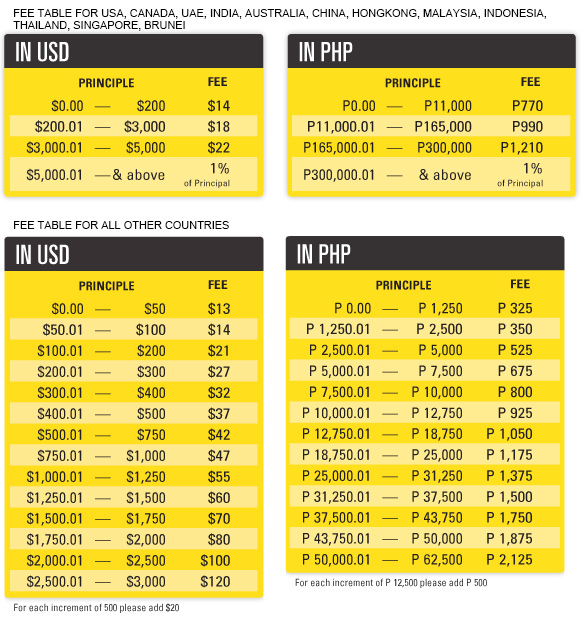

People will no longer have to spend time going to a bank or remittance center to send or receive money via Western Union or MoneyGram. They also avoid paying the expensive transaction fees that Western Union charges. Please study the chart below, Western Union's lucrative grip on remittance business will certainly lose customers once those people realize Facebook Messenger is now offering a free method to send/receive money.

Source: Western Union Philippines

The money transfer feature of Facebook Messenger will only initially be enabled in America but the huge number of Facebook users outside the U.S. will eventually compel Zuckerberg to expand the feature to other countries. The potential damage to Western Union and MoneyGram is significant considering they are the two top players in the global remittance business.

PayPal Might Also Get Hurt

Former PayPal president, David Marcus, got hired last June and became chief of Facebook Messenger. Marcus definitely played a big role in the implementation of the peer-to-peer payment feature. While the current version is only limited to personal transactions, I speculate that the money transfer feature could be upgraded for use to pay commercial goods from online stores or individual sellers.

I made it very clear last year that the Facebook ecosystem is already a bustling users-initiated place of e-commerce. Marcus got hired because of his digital payments expertise. He will not be doing job if he doesn't enable the payment-to-commercial-sellers option in Messenger.

It might take some time but Facebook will have to monetize this payment feature in Messenger. PayPal makes most of its revenue from customers buying things online. Like PayPal what does now, Marcus will upgrade the peer-to-peer payment system to include payments to commercial sites so Facebook can charge a small fee for every transaction.

The initial free money transfer service of Facebook Messenger is not out of generosity. It is a test phase in preparation to going commercial. Other firms are already monetizing the e-commerce transactions being done at Facebook's platform. Shopify is charging fees to let people open online stores inside Facebook. Storefront Social is another company that charges fees to users who want to put up a store inside Facebook.

The long-term scenario says Facebook Messenger could turn out to be a full digital wallet - useable anywhere like Apple (NASDAQ:AAPL) Pay and Google (NASDAQ:GOOGL) Wallet. The future Facebook digital wallet's biggest advantage will be is that it is platform-independent. The potential customers include the more than one billion people using iOS and Android devices.

As a matter of fact, Facebook made its peer-to-peer money transfer feature also compatible with Apple's Touch ID security. Facebook made it clear that the money transfer system in Messenger is also secured by a double layer of software and hardware encryptions.

There's also going to be a dedicated team of people that will monitor digital payments processed through Facebook Messenger. The payments system is also entirely separate from Facebook's network.

Conclusion

Marcus has extensive years in digital payments. The digital money transfer feature inside Facebook Messenger might be one reason why Zuckerberg decided to spin-off Messenger as a separate mobile app. Creating an independent mobile app does not only improve security. It also makes it easier for Marcus' team to experiment with it.

Experimenting with mobile code is a trial & error undertaking that could have endangered Facebook's core mobile app. Advertisers would not like it very much if Facebook Mobile users suffer from unpredictable events arising from Marcus' codes on digital payments.

Furthermore, Zuckerberg does not want to put ads to monetize the 500 million users of Messenger. Facebook's web and mobile ecosystem are ad-farming cash machines that are incompatible with Zuckerberg's vision for messaging apps. The recent development says Messenger and WeChat could become money transfer service facilitators or digital wallets.

The free peer-to-peer payment system inside Messenger could lead to Facebook becoming a real rival to Xoom, PayPal, Western Union, and MoneyGram. Once Facebook allows credit cards and bank accounts as sources of funds, Facebook will have to charge a fee for every digital payment transaction done through Messenger.

The global mobile payment transaction market will be worth $2.85 trillion by 2020. Facebook's growth prospect therefore just got better with Facebook Messenger now enabling people to send money. Facebook's future is no longer exclusively tied to mobile advertising. It is true that Facebook's success is due to its explosive growth in advertising.

Source: Statista

However, investors should now also take into account the multi-trillion dollar opportunity in digital payments when evaluating the future of Facebook. I say FB is a Buy. Facebook, by virtue of its viral popularity, could be a credible future digital payments leader.

The chart below ought to reassure investors that Facebook remains a momentum growth company. The 5-year EPS growth prediction for FB is 31.44%, still higher than the average 12.64% 5-year EPS growth estimate for its technology sector peers.

Source: Alpha Omega Mathematica

http://news.iapplefan.com/inews/facebooks-money-transfer-service-could-hurt-western-union-moneygram-paypal-and-xoom

edited by kcontents

"from past to future"

데일리건설뉴스 construction news

콘페이퍼 conpaper

.